Introduction

Tracking your money is necessary as it will tell you your spending patterns and help you budget in a better way. You may not realize just how much money you are spending on dinners or shopping online but it all adds up in the end and the result is not positive.

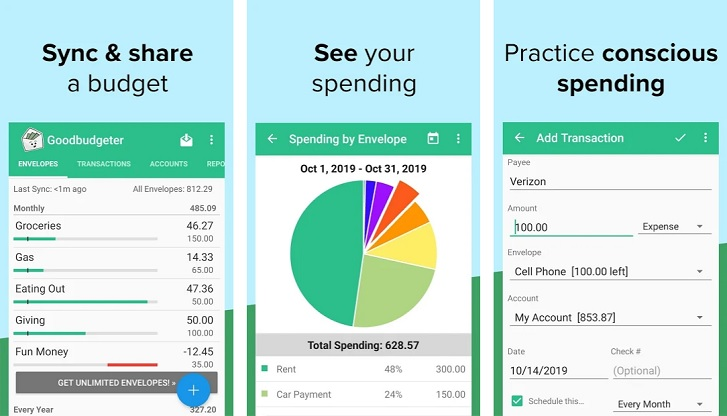

An income and expenses app keeps you on track, financially. They display your spending and expenses which helps you in making clever budgets. A great budget app is the Goodbudget app.

Especially, for beginners, the Goodbudget app is helpful as it has manual categorization. Users can manually input their information through the ‘Envelope Method’. When users make categories and input their spending by themselves, they are conscious of their expenses and are likely not to overspend.

Goodbudget App Full Review

Below, we are breaking down the Goodbudget app review in detail.

Goodbudget App Tools

The users make different categories, label them anything they want, and assign a certain amount of money to each category. For example, they can make labels such as, ‘rent’, ‘electricity bill’, ‘groceries’ etc.

This is the ‘Envelope Method’ that enables users to track their spending. By doing this, users can digitally monitor their expenses and be more mindful of their financial choices.

People who are new to budgeting can start their financial planning with the Goodbudget app. You can plan your future expenses by using this income and expenses app. When users spend more than what they assigned to the category, a red line will appear that will indicate that they are spending over the limit. This helps users spend under the budget.

A prominent feature of the Goodbudget app is that it does not link to the users’ bank accounts or credit cards. Instead, the users are allowed to manually input their different transactions’ information in different categories.

How the Goodbudget App Can Benefit You?

One of the biggest benefits of this income and expenses app is that it allows users to manually enter their different expenses. Automated entries may not have the desired impact on your spending habits than manual entries. When you enter your expenses by yourself, you constantly keep track of where your money is spent. This way, you can avoid any unnecessary expenses.

The Goodbudget app is a good starting point for beginners as they can see their transactions as they are conducting them. This helps them in cutting down their wasteful spending. These can include but are not limited to any impulse shopping, old subscriptions, etc.

While the Goodbudget app does not allow users to sync their bank accounts and credit cards, users can still download their transactions’ activity from their bank website and import it into the app if they like.

This income and expenses app provides several educational resources such as free online courses, blog posts articles, podcasts, etc.

Keep your Finances Safe with the Good Budgeting App

The Goodbudget app has great security features that facilitate users in safeguarding their data trouble-free. It has powerful bank data encryption that sends codes that let users securely access their information.

The financial information of any user is quite sensitive so the top priority is to shield that data from any breach, ensuring that it does not get stolen. With different third-party integrations, the issue arises that access to this data is distributed, a lot. This income and expenses app makes sure that the user data is highly protected and cannot be breached.

Pricing Plan of the Goodbudget App

In the free version of the Goodbudget App, users can create upto 20 different envelopes, use a single account on 2 different devices, and track the history of a whole year with debt tracking and community support.

There is also a premium paid version of the Goodbudget app, Goodbudget Plus. In this version, users have access to unlimited envelopes which are $7 per month and $60 per year. This version also has unlimited account users who can use the accounts on 5 different devices. It provides 7 years of tracking history, debt tracking, and email support.

Goodbudget App - Availability & User-Ratings

This income and expense app is available for iOS and Android. Compatible with many devices, the Good App provides basic financial features to its users with ease. It also has a web-based version.

The user rating is 4.2 stars out of 5 with 19.2K reviews for Android.

The user rating is 4.7 stars out of 5 with 12.8K Ratings for iOS.

Why Should You Choose Goodbudget App?

The choices are countless when it comes to financial tracking apps but an easy yet effective choice is the Goodbudget app. This app is best for beginners as it gives them the much-needed push to spend and manage their money consciously. With manual categorization and specific budget limitations, users can ensure that they are not overspending with Goodbudget.

Check out our 5 Best Expense Tracker App of 2024 here.

FAQs

What is Goodbudget?

The Goodbudget is a financial tracking app that helps you manage your financing through the envelope method.

Is Goodbudget a free app?

Goodbudget app offers both versions. The free version allows only 1 financial account while the premium version, Goodbudget Plus costs $7 per month or $60 per year.

Does Goodbudget allow syncing of a Goodbudget account across multiple devices?

Yes. Goodbudget allows users to sync their Goodbudget accounts to multiple devices by using the same credentials. You can easily access and edit your budget by accessing your account on your smartphones or tablets.

Does Goodbudget offer reporting and analysis features?

Yes. The Goodbudget app offers great reporting and analysis features that allow users to monitor their spending behaviors, view their budget progress, and identify areas where they are overspending.

Can I link my bank accounts to Goodbudget?

In the free version of Goodbudget, you cannot link your bank accounts to the app but in the premium version which is Goodbudget Plus, you can. This will provide automatic transaction syncing.

Can I customize my spending categories in Goodbudget?

Absolutely. You can customize your spending categories in Goodbudget according to your specific needs. This way, you can create envelopes that are best suited to your preferences and financial objectives.